Running an online store without business insurance is like flying a plane without a parachute. You can focus on the view—sleek products, a killer website, happy customers—but one unexpected tailspin can end the whole flight.

Business insurance for an online store is that parachute. It protects your personal assets, signals you’re a pro, and gives you the peace of mind to focus on climbing higher.

Why Smart Founders Get Business Insurance from Day One

Too many founders see insurance as a boring expense for "later." But seasoned entrepreneurs treat it as a strategic asset from the start. This isn’t about checking a box; it's about building a business that can take a punch.

Think of your business as a high-performance car you’ve poured your life into. Insurance is the roll cage and safety harness. You hope you never need them, but they’re why you can slam the accelerator, knowing one spin-out won't be a total wreck.

A Shield for Your Personal and Professional Life

Without the right coverage, there’s no wall between your business debts and your personal bank account. A lawsuit over a faulty product could drain your savings or force a lien on your house. It happens.

Business insurance builds a legal and financial firewall. If the company goes sideways, the damage stops there. Your personal finances stay safe.

This is the bedrock of serious entrepreneurship. It tells partners, suppliers, and customers you're not just a hobbyist—you're a stable, professional operation built to last.

Unlocking Growth and Building Trust

Insurance isn’t just defense. It's an offensive tool. Many big growth opportunities—getting into major retailers, landing a huge distributor—are impossible without proof of insurance. Having it ready lets you say "yes" when those chances arrive.

- Builds Partner Credibility: Wholesalers, fulfillment centers, and giants like Amazon require specific insurance minimums. No exceptions.

- Enables Aggressive Scaling: A safety net allows you to invest in new product lines or try ambitious ecommerce growth strategies without the constant fear that one mistake could sink you.

- Strengthens Your Brand: It shows you’ve planned for the worst. That foresight builds trust and reinforces your reputation for reliability.

Over the last decade, coverage has become non-negotiable for digital brands. Global e-commerce sales soared past an estimated $5.8 trillion in 2023 and are projected to hit $8 trillion by 2027. More growth means more risk, and platforms are tightening their rules. Thankfully, basic policies for new stores still often start under $1,000 a year. With claims rising, marketplaces will be asking for that proof of insurance sooner, not later.

The Essential Insurance Toolkit for Your Online Store

Think of business insurance as a specialized toolkit for your shop. You wouldn't hammer a nail with a wrench. The trick is knowing which tool protects you from which danger. You don't need every tool, but you absolutely need the right ones.

This is your blueprint. Forget the confusing jargon. Let's break down the essential policies every online store owner needs, piece by piece, using real-world scenarios you can actually picture.

General Liability: The All-Purpose Screwdriver

Think of General Liability Insurance as the trusty screwdriver in your kit. It's the foundational tool for a wide range of common business risks. This policy shields you from claims of bodily injury or property damage that happen during your operations but aren't directly caused by your products.

Imagine: a delivery driver drops off supplies at your Chicago apartment and trips over a box in the hallway. Or you’re at a craft fair, and your booth sign falls, cracking someone’s laptop screen. General liability steps in to handle the legal and medical bills. It’s the basic barrier that keeps a simple accident from becoming a lawsuit that drains you before you've even started.

Product Liability: Your Most Important Specialty Tool

If you sell physical products, Product Liability Insurance is the single most critical tool you'll own. This isn't a "nice-to-have." It’s an absolute must. This coverage is designed for claims of injury or damage caused by the things you sell.

This is where the real e-commerce risk lives. A customer claims your handmade soap caused a nasty allergic reaction. A part in a toy you import breaks off, becoming a choking hazard. These aren't just hypotheticals; they’re the exact scenarios that obliterate small businesses.

Your general liability policy might not cover product-related claims. You must be certain you have specific product liability coverage. It is the single most important piece of business insurance for an online store.

Without it, you are personally on the hook for medical bills, legal defense, and massive settlements. This coverage is what lets you sleep at night.

Cyber Liability: The Digital Locksmith

Every online store handles sensitive customer data—names, addresses, payment info. Cyber Liability Insurance is your digital locksmith, protecting you when those virtual doors get kicked in. Today, a data breach isn't a matter of if, but when.

If a hacker steals your customer list, the fallout is immense. You face regulatory fines, the cost of credit monitoring for every customer, and a PR nightmare that sinks your brand. A cyber policy is built to manage these exact costs, helping your business survive and recover. For a small store, a breach can feel fatal. This insurance gives you the resources to manage the crisis professionally instead of closing up shop.

Other Essential Tools You Might Need

As your business grows, your toolkit must expand. The three policies above are your starting point, but other specialized tools become necessary as you scale.

- Business Owner's Policy (BOP): Like a pre-packaged toolkit, a BOP bundles General Liability, Commercial Property (to protect inventory and equipment), and Business Interruption insurance into one policy, often at a lower cost.

- Professional Liability Insurance: Also known as Errors & Omissions (E&O), this is vital if you sell services or provide advice. If you offer marketing consulting and a client sues you for bad advice that cost them money, this policy has your back.

- Workers' Compensation: The second you hire your first employee in Illinois—even part-time—the state requires Workers' Comp. It covers medical costs and lost wages for employees hurt on the job, protecting them and you from lawsuits.

Getting a handle on these tools is fundamental for any founder. For those just starting, our complete guide on how to start an ecommerce business offers a broader look at all the foundational steps.

Your Online Store's Insurance Toolkit at a Glance

Here’s a quick summary of what these core policies do and a ballpark of what a new Chicago brand might pay.

| Insurance Type | What It Protects You From | Typical Annual Cost for a Small Store |

|---|---|---|

| General Liability | Third-party injuries and property damage from your operations (not products). | $350 – $700 |

| Product Liability | Injuries or damages caused directly by the products you sell. | $500 – $2,500+ (highly variable) |

| Cyber Liability | Financial losses from data breaches and cyberattacks. | $650 – $1,800 |

| Business Owner's Policy (BOP) | A cost-effective bundle of General Liability and Property insurance. | $500 – $1,500 |

These are just estimates. The final cost depends on your sales volume and what you sell. Insuring baby clothes is cheaper than insuring electronic skateboards. The key is to match the tool to the risk, building a protective foundation that lets your brand grow safely.

Meeting Marketplace Rules on Amazon, Etsy, and Shopify

Selling on a major platform is like renting a storefront in a high-end mall. You get incredible foot traffic, but you play by the mall's rules. Many founders are surprised to learn platforms like Amazon don't just recommend insurance—they require it once your sales hit a certain level.

These rules protect the entire ecosystem: customers, the platform, and you. When one seller has a major issue, it can shake everyone's trust. By ensuring sellers are insured, marketplaces know you're a serious business that can handle problems without creating a domino effect.

Decoding the Platform Requirements

The fine print varies, but the core demand is similar. They want to see your safety net, and their main focus is liability coverage.

- Amazon: Amazon is the strictest. The moment you cross $10,000 in gross monthly sales, you need Commercial General Liability insurance. Your policy must have at least $1 million in coverage per occurrence and in total, and you must name "Amazon.com, Inc., and its affiliates and assignees" as additional insureds.

- Shopify: Shopify itself doesn't force insurance on you. But—and this is a big "but"—the third-party apps, payment gateways, or fulfillment partners you use often do. It’s their rules you have to watch.

- Etsy: Right now, Etsy doesn't have a hard insurance requirement. As the platform grows, I wouldn't be surprised if that changes. More importantly, flying blind on any platform is just asking for trouble.

What Is a Certificate of Insurance (COI)?

When Amazon asks for "proof of insurance," they mean a Certificate of Insurance, or COI.

Don't let the name intimidate you. A COI is just your insurance ID card. It's a simple, one-page summary from your insurer that outlines your coverage.

A COI quickly proves you have the right policy and meet the required limits. It lists who is insured, policy dates, coverage amounts, and any "additional insured" parties, like Amazon.

Getting one is easy. Once your policy is active, just ask your insurance broker. They can usually produce one in minutes at no cost.

Meeting platform minimums is your ticket to the big leagues. But that's all it is—a ticket. The $1 million liability limit Amazon requires is a solid foundation, not a custom fortress for your specific business.

If you sell something high-risk, like baby products, that baseline coverage is like bringing a squirt gun to a wildfire if a serious lawsuit hits. The real goal isn't just to check a box. It's to build a business that can take a punch and keep going. Use their rules as your starting point, then talk to a pro to build a plan that actually protects your brand's future.

Locking Your Digital Doors: Protecting Your Store from Hackers and Data Leaks

Your online store has digital doors and windows that need locking, just like a physical shop. For e-commerce founders, cyber risk is the modern threat that can shut you down overnight. The danger goes beyond a simple website outage.

The real risks are quiet and devastating. One convincing phishing scam can give a criminal the keys to your entire operation. A bit of malware can steal your customers' credit card data, leaving you to clean up the mess. This isn't a distant possibility; it’s a daily reality.

Cyber Liability Insurance: Your Financial Firewall

Think of Cyber Liability Insurance as a financial firewall. When a digital threat punches through, this policy kicks in to control the damage and cover the astronomical costs. It's built for the unique chaos that follows a data breach.

A common mistake is thinking a secure gateway like Stripe or PayPal makes you safe. While those services are essential, they don't protect the customer data stored on your systems—email lists, shipping addresses, account histories. That data is your responsibility.

After a breach, your biggest problems aren't technical; they're financial and legal. Cyber liability insurance handles the expensive aftermath, covering costs that could easily bankrupt a growing online store.

This coverage is your response plan in a box, ready the moment a crisis hits.

So, What Does Cyber Insurance Actually Cover?

What happens when you use it? Cyber insurance is a bundle of protections designed to manage a complex disaster. It helps you pay for critical, often legally required, recovery efforts.

Here's what a policy usually helps with:

- Customer Notification Costs: Paying to legally notify every customer whose data might have been exposed.

- Credit Monitoring Services: Covering services to help your customers protect their credit and identity.

- Legal Fees and Fines: Handling legal defense bills and regulatory penalties.

- Public Relations: Hiring experts to manage the fallout and repair your brand's reputation.

- Data Recovery: Paying forensic IT pros to figure out what happened and restore your systems.

Without this specialized business insurance for an online store, you'd pay for all of this out of pocket. For most founders, that's an impossible climb.

Making Powerful Cyber Coverage Affordable

The good news? Basic digital hygiene makes strong cyber coverage more affordable than you'd think. Insurers reward proactive founders. Simple security controls show them you're a lower risk, which leads to better premiums.

Ignoring cyber risk is one of the most statistically expensive bets you can make. IBM’s Cost of a Data Breach Report found the average breach cost over $4.4 million per incident in 2023. Insurers get this. They've made cyber policies more accessible, especially if you're serious about security. You can often get meaningful limits—like $250,000 to $1 million—for hundreds, not thousands, of dollars a year by using simple tools like multi-factor authentication (MFA) and running regular data backups. You can learn more by checking out these small business insurance trends on rcins.com.

Protecting your digital storefront isn't optional. A cyber liability policy is the essential lock on your virtual front door, ensuring one hacker can't steal your customers' trust and your company's future.

How to Buy Your First Insurance Policy Without the Headache

Buying business insurance can feel like trying to build IKEA furniture in the dark—confusing and intimidating. But it doesn't have to be. Once broken down, it’s an empowering move for your business. Here’s a simple roadmap to get it done right.

First, get your house in order. Before you can get an accurate quote, you need a clear snapshot of your business. Like preparing documents for a loan, being organized smooths the process.

Gather Your Business Vitals

Think of this as your business's medical chart. Insurers need these core details to understand what they're being asked to protect.

- Business Structure: Are you an LLC, S-Corp, or a sole proprietorship?

- Annual Revenue: Use historical numbers if you have them. If you’re new, provide a realistic 12-month projection.

- Product Details: Be specific. "Handmade jewelry" is okay, but "Handmade sterling silver jewelry with semi-precious stones imported from Brazil" is far better.

- Inventory Value: If your stock was wiped out tomorrow, what would it cost to replace everything? That's the number they need.

- Operational Details: Where do you store inventory—a spare room, a garage, a 3PL? How do you ship products?

Find the Right Insurance Partner

Next, decide who will help you find the policy. You have two main choices: an agent or a broker. Knowing the difference is a game-changer.

An insurance agent works for one specific insurance company (like State Farm). A broker, on the other hand, works for you. They are independent and can shop with dozens of carriers to find the best policy and price.

For most e-commerce businesses, a broker is the way to go. They offer a broader market view and can stitch together a package that actually fits an online brand, rather than cramming you into a generic policy.

Compare Your Quotes Like a Pro

Once you get quotes, resist the urge to just pick the cheapest one. Price is only part of the story. Dig deeper into three key areas.

- Coverage Limits: The maximum an insurer will pay for a single claim and in total for a year. The standard $1 million per claim / $2 million total is a solid start for most online stores.

- Deductible: What you pay out-of-pocket before your insurance kicks in. A higher deductible usually means a lower premium, but don't set it so high you couldn't afford to pay it.

- Exclusions: The fine print—what the policy doesn't cover. You must read this. It’s where you avoid nasty surprises later when you think you’re covered for something but aren't.

A cool secret right now is the softening insurance market. Carriers are competing again, which is great news for well-run online stores. For a Chicago Brandstarters founder, this is a real opportunity. If you can show a tight risk profile—clear labeling, documented safety testing, basic cybersecurity—you're the customer they're fighting over. Good risk management is finally being rewarded with better terms. You can get more insight into top insurance coverage predictions on foagency.com.

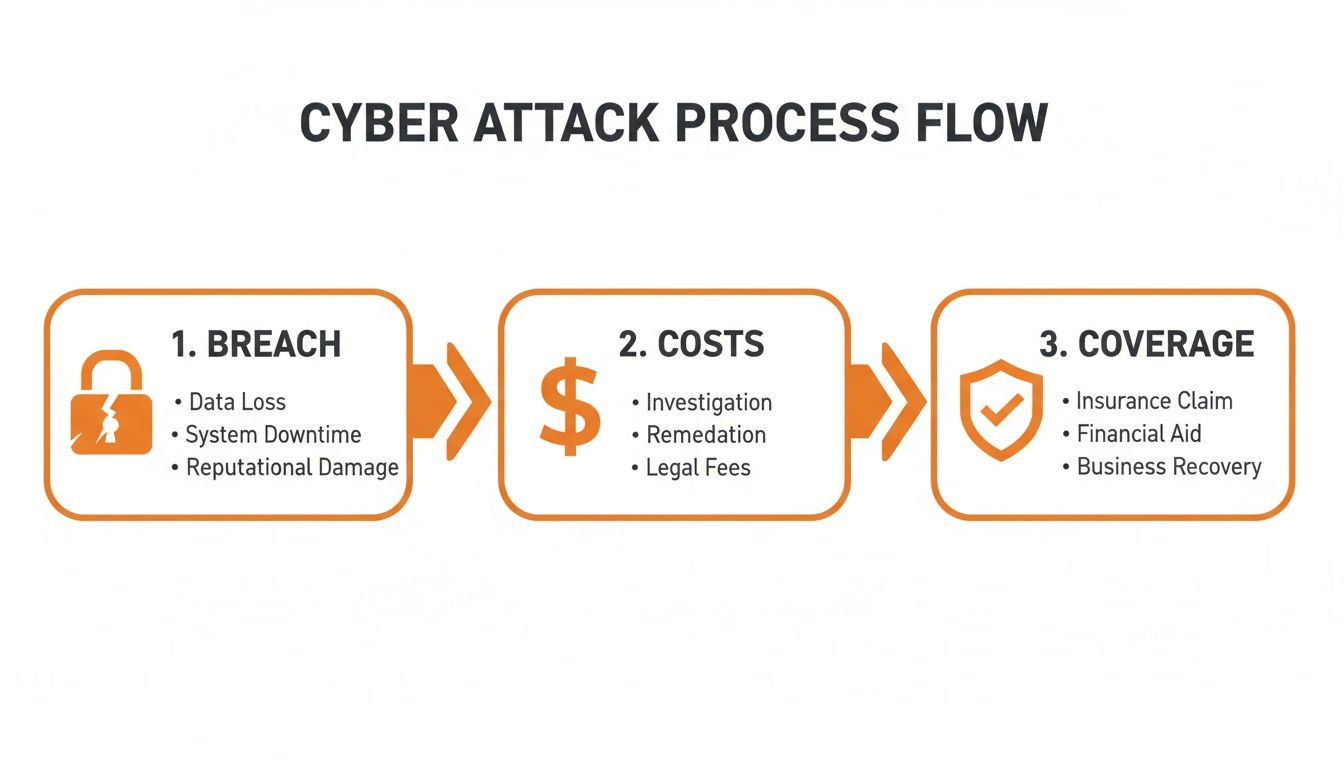

This diagram shows why cyber coverage is so critical. It maps out what happens financially after a breach.

The initial hack is just the beginning. The real pain is the waterfall of costs that follows—and that's exactly what a solid policy is built to absorb for you.

A Chicago Founder's Guide to Local Insurance

Where you build your brand matters. The internet gives you a global customer base, but your daily operations are grounded right here in the Midwest. That means unique risks—and opportunities—that generic online guides miss.

Think of it like this: a California surfer and a Colorado skier both need protection, but they don't wear the same gear. Your insurance policy needs to be tailored for Chicago conditions, not a cookie-cutter template. This is especially true for us in the Chicago Brandstarters community.

Home Office vs. Warehouse Realities

Running your shop from a spare bedroom in Lincoln Park is a different world than operating from a small warehouse in the West Loop. Your insurance has to reflect that reality.

Heads up: a standard homeowners or renters policy will almost always exclude business activities. This leaves a massive, dangerous gap. If a pipe bursts in your apartment and ruins your inventory, your personal policy won't cover a dime. It also won't help if a FedEx driver slips on your icy porch while picking up packages. You need a real business policy, even if you're just starting small. Many of us bootstrap our brands, and if you're figuring out how to start a business with no money, protecting what little you have is mission-critical.

Midwest Weather and Your Inventory

You know how it is here. The weather is wildly unpredictable—polar vortex freezes, summer thunderstorms that flood basements. This is a direct threat to your physical inventory. Water damage and extreme temperature swings can destroy your stock in an instant, making certain coverages more important here than in, say, San Diego.

When getting a quote for property insurance, specifically ask about coverage for "goods in transit" and damage from things like flooding or burst pipes. This ensures your products are protected whether they're in your basement, a local fulfillment center, or a truck stuck in a blizzard on I-90.

Illinois Rules for Your First Hire

This one is a big deal. The moment you hire your first employee in Illinois—even a part-time helper to pack boxes—state law requires you to have Workers' Compensation insurance. This is not optional.

This policy covers medical bills and lost wages if your employee gets hurt on the job. Forgetting it can lead to painful fines. It’s simple: workers' comp protects your employee and shields your business from lawsuits that could bankrupt you. Get this sorted before making that first hire. It's a non-negotiable step for any growing Chicago brand.

A Few Final Questions About Online Store Insurance

Alright, we've covered a lot. But a few "what if" questions are probably still bouncing around in your head. Let's tackle them head-on. Think of this as the final check to ensure you're confident and ready to protect your brand.

"But I Just Have a Small Etsy Side Hustle. Do I Really Need This?"

Yes, you do. The hard truth: a lawsuit doesn’t check your P&L statement to see if you’re a “real” business or a side hustle. If your handmade candle starts a fire or your jewelry causes a nasty reaction, the claim can be life-altering.

Your personal homeowners policy won't touch a business claim. It’s like using your car key to open your house—completely different locks. A basic general liability policy is usually cheap and acts as a crucial firewall, keeping business problems from burning down your personal life. Besides, as you grow, platforms like Etsy will start requiring it anyway.

"What's the Real Difference Between General and Product Liability?"

Let's break it down simply.

Imagine your business is a person. General Liability is like slip-and-fall insurance for that person. It covers accidents they cause by existing—like a delivery driver tripping over a box on your porch. It’s about your operations.

Product Liability is about the stuff that person makes and sells. If something you sold malfunctions, breaks, or hurts someone, this is the policy that steps in. For any brand selling a physical item, this is the big one. Most policies bundle them, but you must be sure your coverage explicitly includes your products.

For an online seller, product liability is the main event, and general liability is the opening act. You need both on the ticket, but one is clearly the headliner.

"I Just Dropship Products. Do I Still Need Insurance?"

Definitely. A classic mistake. When a customer buys from your store, their relationship is with your brand. They don't know or care about some anonymous manufacturer. So when that dropshipped product causes harm, you’re the one they sue.

Relying on your supplier's insurance is like hoping your neighbor's fire extinguisher can save your house. It’s a bad gamble. Your own business insurance for an online store is what protects you. It ensures you aren't left holding the bag if your supplier's policy is weak, has gaps, or doesn't cover you at all.

"Okay, So How Much Coverage Do I Actually Need to Start?"

For a new online store, the gold standard is $1 million per claim and $2 million total for the year. This isn't a random number; it's the minimum required by giants like Amazon and a solid, responsible starting point.

Think of that $1M/$2M limit as the concrete foundation for your financial safety net. As your business grows, or if you sell higher-risk products—like baby items, supplements, or electronics—you'll need to build that foundation higher. A good broker will help you figure out when it's time to add another level.

Ready to connect with other founders who get it? At Chicago Brandstarters, we bring together kind, hardworking builders from across the Midwest to share real stories and support each other's growth. Join a community that values authenticity over hype. Apply to join our free community at chicagobrandstarters.com.